Tax Lien Foreclosures and Surplus Funds – The Supremes Rule

Several prior blog posts discussed the Supreme Court case Tyler v. Hennepin County, Minnesota, which addressed to whether the government could keep surplus funds in tax lien foreclosures. Geraldine Tyler is a 94 year old woman living in Minnesota who owed $2,300.00 in unpaid property taxes for her condominium. Due to her age and safety concerns, she moved to a nursing home and the condominium was sold by the county to pay her unpaid property tax bill.

Several prior blog posts discussed the Supreme Court case Tyler v. Hennepin County, Minnesota, which addressed to whether the government could keep surplus funds in tax lien foreclosures. Geraldine Tyler is a 94 year old woman living in Minnesota who owed $2,300.00 in unpaid property taxes for her condominium. Due to her age and safety concerns, she moved to a nursing home and the condominium was sold by the county to pay her unpaid property tax bill.

The property was sold by the County at auction for $40,000.00. Ms. Tyler’s unpaid tax bill was only $15,000.00 once interest and late fees were included. So what happened to the extra $25,000.00? Under existing law in Minnesota, Hennepin County (the County in which the condominium was located), kept the excess funds for itself.

Ms. Tyler then sued, claiming that allowing the County to keep the funds in excess of what she owed in taxes was an unconstitutional taking of her property. The relevant clause is located in the Fifth Amendment of U.S. Constitution and states that “Nor shall private property be taken for public use, without just compensation.”

Surplus Funds and Tax Lien Foreclosures – A Supreme Update

A prior blog post discussed a case now before the United States Supreme Court relating to surplus funds in tax lien foreclosures. The case involved a 94 year old woman in Minnesota who owed $2,300.00 in unpaid property taxes. The property was sold by the county for $40,000.00. The county then kept the excess funds from the sale, and, under the existing law, did not return the surplus funds to the former homeowner.

A prior blog post discussed a case now before the United States Supreme Court relating to surplus funds in tax lien foreclosures. The case involved a 94 year old woman in Minnesota who owed $2,300.00 in unpaid property taxes. The property was sold by the county for $40,000.00. The county then kept the excess funds from the sale, and, under the existing law, did not return the surplus funds to the former homeowner.

Several states, including New York, have similar laws. In New York State, if your property is sold to pay an overdue tax lien, any funds received from the sale belong to the government, and not to the person whose property was seized, even if they greatly exceed the amount owed in delinquent taxes.

The U.S. Supreme Court recently heard oral arguments on this case. During these arguments, Justice Elena Kagan asked, if the property was worth one million dollars, and the tax bill was only five dollars, would the county keep the excess funds? The attorney representing Hennepin County in Minnesota basically answered in the affirmative.

Collect Them All: Collections and New York Estate Planning

Some of our clients have valuable personal property, such as artwork, antiques, baseball cards, figurines and the like. They may wish to leave such collections in their Wills to a particular person. In other cases, none of the potential survivors is interested in possessing and storing such a collection. This post will address the best means by which to manage collectibles, known as personal property, in estate planning.

Some of our clients have valuable personal property, such as artwork, antiques, baseball cards, figurines and the like. They may wish to leave such collections in their Wills to a particular person. In other cases, none of the potential survivors is interested in possessing and storing such a collection. This post will address the best means by which to manage collectibles, known as personal property, in estate planning.

Collectibles by their nature are of interest mostly only to the collector, who may scour small stores and dealers during his lifetime to obtain such items. The thrill is in the hunt for the unique baseball card that may complete a set and to then enjoy the display of such item in one’s home. Collections of personal property are not only a financial investment to the collector, but provide a lifetime of enjoyment to the collector. Potentially one family member may be interested in acquiring the collection after the person’s death. In such a case, an experienced attorney will advise that the collection be appraised and mentioned specifically in one’s Will, so that it is clear that a particular person should inherit the collection. Then, the person who will receive the collection may receive less from any remaining inheritance to compensate for the value of the collection. For instance, if one child is interested in antique furniture owned by her mother, the mother or the Executor eventually appointed by the Surrogate’s Court can have the furniture appraised. The child who will receive the furniture may receive less cash from the balance of the estate to compensate for the value of the furniture, so that the estate distribution is fair to all involved and the person who appreciates the collection receives it.

Another option is for the collector to give portions of the collection to family members during his lifetime, so that he has the satisfaction of observing the appreciation of family members who receive the items. This is also helpful if the collector is downsizing and selling her home and may not have room for such a vast collection in the new home.

Mediation in New York – A New Hope?

Recently, New York Courts, especially in those in Westchester County, where our offices are located, are encouraging the use of mediation to resolve disputes which have been filed as lawsuits in the Court. What is mediation, and how does it differ from arbitration? Mediation is the use of an independent third party, known as a mediator, in an attempt to resolve a dispute that initially commenced in Court. Many Courts now have a mediation program, and are referring cases to mediation, and, in some cases, ordering that the parties use a mediator to attempt to resolve a Court dispute.

Recently, New York Courts, especially in those in Westchester County, where our offices are located, are encouraging the use of mediation to resolve disputes which have been filed as lawsuits in the Court. What is mediation, and how does it differ from arbitration? Mediation is the use of an independent third party, known as a mediator, in an attempt to resolve a dispute that initially commenced in Court. Many Courts now have a mediation program, and are referring cases to mediation, and, in some cases, ordering that the parties use a mediator to attempt to resolve a Court dispute.

Legally, a mediation is different from arbitration. In arbitration, the parties usually are contractually obligated to use an arbitrator (also an independent third party) by the terms of a previously executed document such as a lease to resolve a dispute. There are organizations such as the American Arbitration Association (AAA) whose purpose is to provide arbitrators to resolve disputes. The main difference between arbitration and mediation is that arbitration, when contractually mandated, results in a binding decision reached by the arbitrator after he hears the case. Once the arbitrator makes a ruling, either party (usually the prevailing party) can file a motion in the appropriate Court to enforce the arbitrator’s decision as a judgment. For example, if the arbitrator rules, after hearing the evidence from all parties, that one party owes the other $50,000.00, that decision can be entered in Court as a binding judgment, after motion made to enforce the arbitration decision.

Conversely, mediation is generally done on the consent of all parties, and is not binding. It is an attempt to mediate the dispute between the parties, and can often replace discovery, Court hearings and a trial. In general, the parties, after appearing in Court for a preliminary conference, can consent to use a mediator in an attempt to resolve the dispute. More frequently, the Judge in the case may order the parties to use a mediator. In such cases, the Court generally provides the parties with a list of potential mediators, and the parties jointly choose a mediator.

New York Real Estate- The Tenant Becomes the Owner

We have observed that the current inventory of houses available to purchase in the area serviced by our attorneys is low. In addition, many houses are rented. When the tenant and landlord have a good relationship, it is not unusual for the parties to agree that the tenant will buy the house from the owner. This post will address the legal issues involved in such a transaction whereby the tenant becomes the buyer and the landlord becomes the seller.

The first action that both parties should take is to engage the services of an experienced real estate attorney. Such a transaction would be considered “for sale by owner” , since neither party would be using the services of a real estate agent. As such, the attorneys will need to develop the particulars of the deal terms that will be included in the contract, such as the purchase price, downpayment amount, whether there are conditions such as a mortgage contingency, and deadlines for obtaining the mortgage commitment and closing. One concern is that the property may not appraise to at least the amount in the contract since it was not offered on the open market through a real estate agent who is familiar with appropriate pricing for the property. If the appraised value is lower than the purchase price, the buyer will not be able to obtain the mortgage in the anticipated amount needed to close.

A tenant occupying the property is already familiar with property condition and may not find it necessary to make repair requests. However, it may behoove the buyer to conduct due diligence and order a professional engineer’s inspection that will evaluate systems servicing the house such as the furnace, hot water heater and roof. These are elements that a tenant may not consider when renting a house, but a potential owner should evaluate before signing a contract. A proposed owner may also be concerned as to whether proper permits exist for improvements made to the house, while a tenant would not have considered such issue before moving in.

Eviction Judgments and Warrants in New York

As the moratorium on eviction cases in New York State due to the COVID-19 pandemic fades into memory, our firm has resumed regular operations regarding landlord-tenant law. In general, this means eviction cases when a tenant may have stayed past the expiration of his lease (known as holdover actions), and those when a tenant is in violation of his lease, usually due to failure to pay rent (non-payment actions).

As the moratorium on eviction cases in New York State due to the COVID-19 pandemic fades into memory, our firm has resumed regular operations regarding landlord-tenant law. In general, this means eviction cases when a tenant may have stayed past the expiration of his lease (known as holdover actions), and those when a tenant is in violation of his lease, usually due to failure to pay rent (non-payment actions).

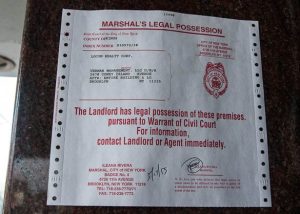

The question this blog post will address is what happens at the end of an eviction action that allows a tenant to be removed from the premises. In order to evict any tenant, the Court must issue a Judgment and a Warrant of Eviction. This can occur in several ways. The first is if the tenant fails to appear in Court, and the Court then issues a default judgment against the tenant. Conversely, if the tenant does appear, the case may eventually go to trial before the Court. If the landlord prevails at trial, again, the Court will allow entry of a Judgment against the tenant.

Finally, it is possible that the parties will agree to a settlement of the action. Usually, that is through the execution of a Stipulation of Settlement. In general, a Stipulation is a compromise of the case. The tenant may agree to leave the premises at a future date certain. For example, if the case is brought in early January, the attorneys for parties may agree that the tenant may vacate the property on or before March 31st. There may be other aspects of the case that are addressed in a Stipulation of Settlement, such as any rent arrears due from the tenant. The agreement may allow the tenant to pay such arrears over time, and, assuming he complies with the payment terms, the landlord may withdraw his case when full payments are made pursuant to the Stipulation.

Rental Housing and Federal Government – New Biden Administration Proposals

Recently in the news are proposals by the Biden administration regarding policies to allegedly protect rental tenants. According to the stories, multiple federal agencies are strongly considering taking actions that are designed to strengthen tenant protections and encourage rental affordability. Of course, experience has shown that well-intentioned government actions often do not have the intended results, and often worsen situations that they are designed to ameliorate.

Recently in the news are proposals by the Biden administration regarding policies to allegedly protect rental tenants. According to the stories, multiple federal agencies are strongly considering taking actions that are designed to strengthen tenant protections and encourage rental affordability. Of course, experience has shown that well-intentioned government actions often do not have the intended results, and often worsen situations that they are designed to ameliorate.

Due to the extreme reaction to the COVID-19 pandemic, there is currently a shortage of residential housing, especially in large cities. This is likely a result of the various eviction moratoriums during the pandemic, which resulted in tenants remaining in housing without paying rent. The effects of these moratoriums, even if they are no longer in effect, continues to the present day. Local landlord-tenant courts are still trying clear the backlog of eviction cases that occurred during the moratorium, especially in large cities such as New York. As a result, new renters are finding that, due to a shortage of supply, rental units have increased greatly in price, as the law of supply and demand has superseded governmental regulation.

The government is proposing executive action to direct the Federal Trade Commission to issue new regulations defining “excessive” rent increases, as well as other protections for renters, such as forcing landlords to wait at least thirty days before commencing eviction proceedings for non-payment of rent.

Surplus Funds and Tax Lien Foreclosures – The Supremes Check In

Prior blog posts have discussed the concept of surplus monies in foreclosure proceedings. When a foreclosed property is sold at public auction, the winning bid may exceed the total amount owed to the entity foreclosing on the property. In such a case, the excess funds are considered “surplus funds,” and the Court-appointed Referee will then deposit the surplus funds with the New York State Department of Finance, which has the authority to disburse the funds to the proper party, upon receipt of a Court order from the Court that handled the original foreclosure case.

Prior blog posts have discussed the concept of surplus monies in foreclosure proceedings. When a foreclosed property is sold at public auction, the winning bid may exceed the total amount owed to the entity foreclosing on the property. In such a case, the excess funds are considered “surplus funds,” and the Court-appointed Referee will then deposit the surplus funds with the New York State Department of Finance, which has the authority to disburse the funds to the proper party, upon receipt of a Court order from the Court that handled the original foreclosure case.

Most foreclosure cases involve mortgage debt to an institutional or individual party, usually involving the amounts borrowed by the owner in order to purchase the property, or a loan taken out on the property after it is purchased, such as a second mortgage. However, there is another category of foreclosures that may generate surplus funds – tax lien foreclosures.

Tax lien foreclosures occur when the owner of real property fails to pay property taxes due on his property. Unless the property is tax-exempt, such as a property owned by a non-profit or religious institution, there are generally local real estate taxes, such as village, city, school, and county taxes assessed to the property. Depending on where the property is located, one or more of these taxes would be assessed to the property, either on an annual, semi-annual, or other type of payment schedule as determined by the taxing entity.