A recent article in the New York Times discusses the pitfalls of reverse mortgages, including the effect such a mortgage may have on the heirs of the borrowers in question. A recent blog post also examined the possible negative legal ramifications of reverse mortgages on seniors and their surviving spouses. This article will discuss possible legal defenses when a reverse mortgage is being foreclosed, or threatened to be foreclosed, by a lending institution.

A recent article in the New York Times discusses the pitfalls of reverse mortgages, including the effect such a mortgage may have on the heirs of the borrowers in question. A recent blog post also examined the possible negative legal ramifications of reverse mortgages on seniors and their surviving spouses. This article will discuss possible legal defenses when a reverse mortgage is being foreclosed, or threatened to be foreclosed, by a lending institution.

The first person to be impacted by a reverse mortgage default is usually the surviving spouse of the borrower. This situation can occur when only one spouse is obligated under the reverse note and mortgage. There are several reasons why this can happen. It is possible that one spouse has poor credit, and cannot qualify for a loan. In addition, in order to qualify for a reverse mortgage, the borrower must be at least 62 years old. A couple may own a property jointly, where one spouse is over 62, and the other is younger. In that case, the reverse mortgage may be made to only the older of the owners. In this example, the lender will often force the non-borrowing spouse to remove their name from the title of the property being borrowed against as a condition to making the loan. This may cause additional legal problems if the non-titled spouse survives the borrowing titled spouse.

If the borrowing spouse passes away, the terms of the reverse mortgage usually call for the entire sum that was borrowed to be immediately paid in full. The surviving spouse may receive collection letters from the lender, demanding that the mortgage be repaid in full. This obviously comes at a time when the surviving spouse is probably undergoing emotional and financial stress.

Our readers may have read a

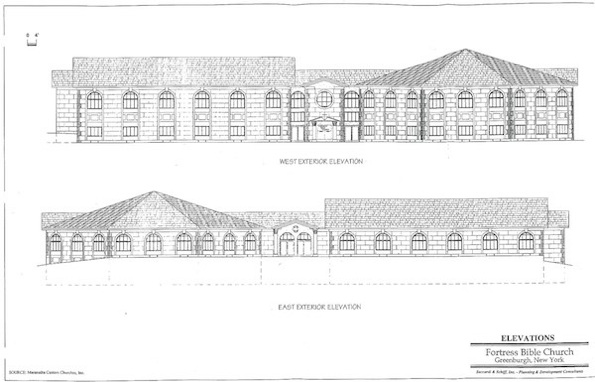

Our readers may have read a  In 1999, the Town Board of Greenburgh, located in Westchester County, New York, reviewed an application of the Fortress Bible Church to build a church and school on land that it owned within the Town borders. After review by the Town Board, the Board rejected the application, claiming that there were safety concerns regarding inadequate stopping distance from the main road to the Church entrance, as well as general safety issues related to traffic entering and exiting the Church site.

In 1999, the Town Board of Greenburgh, located in Westchester County, New York, reviewed an application of the Fortress Bible Church to build a church and school on land that it owned within the Town borders. After review by the Town Board, the Board rejected the application, claiming that there were safety concerns regarding inadequate stopping distance from the main road to the Church entrance, as well as general safety issues related to traffic entering and exiting the Church site.  The Associated Press recently reported about a

The Associated Press recently reported about a  A

A  In

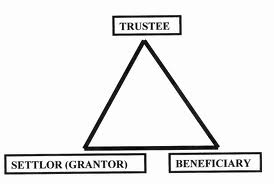

In  Trusts provide a valuable tool in estate planning because they serve the purposes of preserving assets, protecting intended beneficiaries, and potentially saving or eliminating estate taxes. A trust is a legal document that conveys a “corpus”, or body of assets, from the settlor (the person who creates the trust and owns to assets) to a trustee (the individual or corporate entity with the responsibility of holding the assets) for the benefit of the beneficiary (the person who will ultimately receive the proceeds of the trust). A charitable organization may also be the beneficiary of a trust.

Trusts provide a valuable tool in estate planning because they serve the purposes of preserving assets, protecting intended beneficiaries, and potentially saving or eliminating estate taxes. A trust is a legal document that conveys a “corpus”, or body of assets, from the settlor (the person who creates the trust and owns to assets) to a trustee (the individual or corporate entity with the responsibility of holding the assets) for the benefit of the beneficiary (the person who will ultimately receive the proceeds of the trust). A charitable organization may also be the beneficiary of a trust.