Trademarks and the Washington Redskins Decision

Recently in the news is a decision by the United States Trademark Trial and Appeal Board concerning the registration of the trademark for the Washington Redskins football team. Longtime readers of this blog will recall that a prior post explained the difference between copyrights and trademarks. To summarize, a trademark is legal protection for a trade or business name used to identify goods and services in interstate commerce. To obtain such protection, one generally applies to the United States Patent and Trademark Office in Washington, D.C. The applicable procedure is one which can be done online. Our attorneys are familiar with the application process and can assist potential applicants.

Recently in the news is a decision by the United States Trademark Trial and Appeal Board concerning the registration of the trademark for the Washington Redskins football team. Longtime readers of this blog will recall that a prior post explained the difference between copyrights and trademarks. To summarize, a trademark is legal protection for a trade or business name used to identify goods and services in interstate commerce. To obtain such protection, one generally applies to the United States Patent and Trademark Office in Washington, D.C. The applicable procedure is one which can be done online. Our attorneys are familiar with the application process and can assist potential applicants.

Once the application is submitted, an examiner at the United States Patent and Trademark Office will review the proposed trademark. They will check as to whether the proposed mark is “confusingly similar” to any prior registered mark, and may deny the application if it is. Other technical issues may also be raised by the trademark examiner.

If the applicant has an issue with the decision of the trademark examiner, then the trademark examiner’s decision can be appealed to the United States Trademark Trial and Appeal Board (TTAB). Any such appeal would be heard by a panel of three Administrative Trademark Judges. Each Judge will then vote on the appeal, with the majority becoming the decision of the TTAB in a particular case.

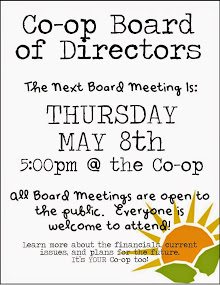

Our Guide on How to Conduct Cooperative Board of Directors Meetings

In a prior blog post , we described how annual cooperative shareholder meetings should be conducted. Now that the cooperative’s Board of Directors is properly elected and in place, the business of the cooperative should begin with the holding of a meeting of the Board and electing officers. This blog post will describe how to conduct regular Board of Director meetings in a cooperative.

In a prior blog post , we described how annual cooperative shareholder meetings should be conducted. Now that the cooperative’s Board of Directors is properly elected and in place, the business of the cooperative should begin with the holding of a meeting of the Board and electing officers. This blog post will describe how to conduct regular Board of Director meetings in a cooperative.

It is not unusual for By-Laws to require a newly elected Board to meet immediately after the annual shareholders meeting, even if such a meeting has not been noticed. Otherwise, By-Laws may require advance notice of the Board meeting. While Board meeting notices usually do not need to specify an agenda, we recommend that an agenda be circulated prior to the meeting so that those in attendance are prepared for the discussion of cooperative business and are not surprised by any of the topics.

At the first Board meeting, it is prudent to elect the officers, such as the President, Vice-President, Secretary and Treasurer. The By-Laws will identify those officers to be elected for a particular cooperative as well as their roles. Review of the By-Laws must be made to confirm the quorum (the minimum number required to hold a valid meeting) required for the Board meeting, whether a majority or other percentage of directors. Once it is determined that there is a quorum present at the Board meeting, the By-Laws should be consulted to note voting requirements. Does a mere majority vote or a higher percentage allow for the passage of resolutions discussed? Particular matters, such as enacting additional fees like a flip tax, may require a vote of more than a majority, such as two-thirds. A flip tax is a fee paid to the cooperative at a closing by the seller and may be calculated as a flat amount, a percentage of the sales price, a percentage of the net profit of the sale, or by assigning a particular number of dollars per share owned by the seller. A flip tax is intended to enhance the account balance of the cooperative and share some of the seller’s sales proceeds with the building. Since flip taxes comprise an additional fee, it is not unusual for voting to require more than a majority or for such a matter to be considered by all shareholders, instead of merely the Board.

Enjoy Your Vacation Home this Memorial Day Weekend

Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend, we wish to remind you of certain legal issues pertaining to vacation homes.

Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend, we wish to remind you of certain legal issues pertaining to vacation homes.

Some vacation homes were financed by the use of reverse mortgages . Once the borrower dies or does not occupy the home for another reason, the lender may seek to collect the remaining unpaid principal balance, require the home to be sold or foreclose on the property. Since vacation homes are secondary homes, obtaining a mortgage modification, if necessary due to the financial circumstances of the borrower, is not a certainty. We are available to assist our clients in foreclosure defense should it become necessary.

Sometimes a vacation home is inherited by more than one adult child. In this case, maybe not all of the record owners contribute to the expenses of the house or even use the house. Our firm has been engaged in partition actions on behalf of its clients to alleviate this situation.

‘Tis the Season for the Annual Meeting

May and June of each year tend to be “annual meeting season” for our cooperative and condominium clients. At such meetings, the shareholders of cooperatives and unit owners of condominiums elect their board of directors or board of managers. Those who serve on boards are hard working volunteers, participating on a weekly if not daily basis. Those who attend annual meetings may only attend one meeting a year to question and judge those who participate on their behalf on a constant basis. This blog post will address how to properly conduct annual meetings and why smoothly run annual meetings are important. Although our law firm also conducts annual meetings for condominiums and religious corporations, this post will be limited to cooperative corporation annual meetings.

May and June of each year tend to be “annual meeting season” for our cooperative and condominium clients. At such meetings, the shareholders of cooperatives and unit owners of condominiums elect their board of directors or board of managers. Those who serve on boards are hard working volunteers, participating on a weekly if not daily basis. Those who attend annual meetings may only attend one meeting a year to question and judge those who participate on their behalf on a constant basis. This blog post will address how to properly conduct annual meetings and why smoothly run annual meetings are important. Although our law firm also conducts annual meetings for condominiums and religious corporations, this post will be limited to cooperative corporation annual meetings.

Why do we have annual meetings? Such meetings are necessary to elect directors at regular intervals, so that the same people do not maintain their posts indefinitely contrary to the will of shareholders. An Offering Plan would have been filed by the sponsor of the cooperative with the New York State Attorney General Real Estate Finance Bureau when the building was converted to cooperative ownership. One of the documents contained in such Offering Plan is the By-Laws. As in any corporation, the By-Laws provide the roadmap for the governance of the corporation. It is common for By-Laws to provide that annual meetings for the election of directors are to be held in a particular month of a year. The cooperative need not hold its meetings in the specific month stated in the By-Laws (who wants to meet in January during a blizzard), it merely needs to hold its meetings at regular intervals each year. The By-Laws specify that the notice of annual meeting is to state that the business to be conducted is to elect directors and to conduct other business specifically identified in the notice, should state the time, date and place of the meeting, and who needs to sign the meeting notice. Our attorneys also pay careful attention to each client’s By-Laws provision regarding the number of days required for the advance notice of the meeting. Usually cooperative By-Laws require that written notice of the annual meeting be delivered at least “x” days but no more than “y” days in advance of the meeting. The By-Laws will also indicate how many directors are to be elected and if there are particular disqualifications (such as a director must also be a shareholder).

it merely needs to hold its meetings at regular intervals each year. The By-Laws specify that the notice of annual meeting is to state that the business to be conducted is to elect directors and to conduct other business specifically identified in the notice, should state the time, date and place of the meeting, and who needs to sign the meeting notice. Our attorneys also pay careful attention to each client’s By-Laws provision regarding the number of days required for the advance notice of the meeting. Usually cooperative By-Laws require that written notice of the annual meeting be delivered at least “x” days but no more than “y” days in advance of the meeting. The By-Laws will also indicate how many directors are to be elected and if there are particular disqualifications (such as a director must also be a shareholder).

Once the meeting commences, the first step is to determine if there is a quorum, the proper number of shares represented for the decisions made at the meeting to be legally valid. The By-Laws identify how many shares constitute a quorum, perhaps a majority of shares issued or a majority of units are represented. Usually, shares can be represented by attending in person or by proxy (the delivery of a signed document instructing how one’s shares are to be voted or who may vote one’s shares on her behalf). It should be noted that certain legal acts or acts as identified by the certificate of incorporation may have a more stringent definition of quorum than the standard director election. As it is inconvenient to adjourn the meeting due to failure of quorum requirements, we encourage our clients to collect as many proxies as possible in case a shareholder cannot attend.

New Yorkers Will Always Have Death and Taxes

New Yorkers seem to be “taxed to death”, paying the highest average property taxes in the country. We are the only state that charges a tax for the making of a mortgage. The tax burden does not end at death, as New York also has its own estate tax. Governor Andrew Cuomo, seeking re-election this year, has been encouraging the state legislature to reduce these burdens.

New Yorkers seem to be “taxed to death”, paying the highest average property taxes in the country. We are the only state that charges a tax for the making of a mortgage. The tax burden does not end at death, as New York also has its own estate tax. Governor Andrew Cuomo, seeking re-election this year, has been encouraging the state legislature to reduce these burdens.

Estates may be subject to both federal and state estate taxes. During the past thirteen years, the federal estate tax has been modified. The federal taxable exemption now stands at a generous amount of $5,340,000.00 per person. This generally means that estates that do not exceed this amount are not subject to federal estate taxes. As many people do not have estates that exceed such amount, federal estate tax is not a concern for most families. However, New York State has levied an estate tax on estates exceeding $1,000,000.00 until a revision to the law was passed in April of this year. Since many New Yorkers could easily have assets exceeding $1,000,000.00, considering high property values, many of our residents have been subject to state estate tax.

The revision to New York’s estate tax law now provides that the exemption will immediately rise to $2,062,500.00, so that only estates valued above that amount will be subject to New York state estate taxes. Further, each April, the state estate tax exemption is set to rise by $1,062,500.00, until it reaches $5,250,000.00 in 2017, then the exemption will continue to rise to close to $6,000,000.00 on January 1, 2019. Tax liability will certainly be a “moving target” during the next five years.

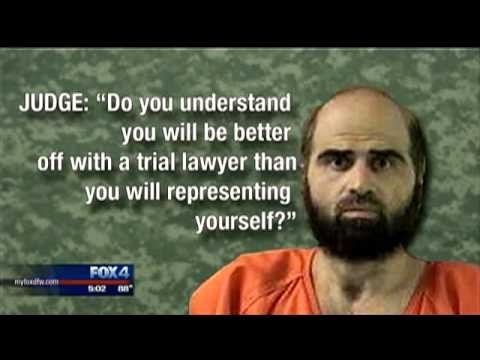

“Self-Help” and Legal Representation in Foreclosure and Landlord-Tenant Matters

Our firm often receives inquiries from potential clients, many related to foreclosure and landlord-tenant matters. Often, an individual will inform us that they have been representing themselves in a Court proceeding, or are considering doing so, and will question us as to whether an attorney is necessary.

Our firm often receives inquiries from potential clients, many related to foreclosure and landlord-tenant matters. Often, an individual will inform us that they have been representing themselves in a Court proceeding, or are considering doing so, and will question us as to whether an attorney is necessary.

In New York State, individuals are generally permitted to represent themselves in Court proceedings, without an attorney. One exception to this is a corporation. Even if an individual is the sole owner of a corporation, corporations must generally be represented by counsel when they are a party to a litigation proceeding.

However, simply because an individual may representative herself in Court, does not mean that this is the best decision when confronted with an adversarial proceeding concerning potentially sophisticated legal issues, such as a foreclosure proceeding, or landlord-tenant matter. Many of the people who make inquiries to our firm will ask what benefit is gained from hiring an attorney, especially since there is an increased cost involved when attorney’s fees are incurred.

Defending Reverse Mortgage Foreclosures

A recent article in the New York Times discusses the pitfalls of reverse mortgages, including the effect such a mortgage may have on the heirs of the borrowers in question. A recent blog post also examined the possible negative legal ramifications of reverse mortgages on seniors and their surviving spouses. This article will discuss possible legal defenses when a reverse mortgage is being foreclosed, or threatened to be foreclosed, by a lending institution.

A recent article in the New York Times discusses the pitfalls of reverse mortgages, including the effect such a mortgage may have on the heirs of the borrowers in question. A recent blog post also examined the possible negative legal ramifications of reverse mortgages on seniors and their surviving spouses. This article will discuss possible legal defenses when a reverse mortgage is being foreclosed, or threatened to be foreclosed, by a lending institution.

The first person to be impacted by a reverse mortgage default is usually the surviving spouse of the borrower. This situation can occur when only one spouse is obligated under the reverse note and mortgage. There are several reasons why this can happen. It is possible that one spouse has poor credit, and cannot qualify for a loan. In addition, in order to qualify for a reverse mortgage, the borrower must be at least 62 years old. A couple may own a property jointly, where one spouse is over 62, and the other is younger. In that case, the reverse mortgage may be made to only the older of the owners. In this example, the lender will often force the non-borrowing spouse to remove their name from the title of the property being borrowed against as a condition to making the loan. This may cause additional legal problems if the non-titled spouse survives the borrowing titled spouse.

If the borrowing spouse passes away, the terms of the reverse mortgage usually call for the entire sum that was borrowed to be immediately paid in full. The surviving spouse may receive collection letters from the lender, demanding that the mortgage be repaid in full. This obviously comes at a time when the surviving spouse is probably undergoing emotional and financial stress.

Marital Rights in a New York Estate

Our clients have inquired as to the consequences of the termination of a martial relationship upon rights in a New York estate. The resolution to this issue depends upon whether the relationship was legally terminated through a divorce and whether the estate is being conducted as an administration or a probate proceeding. Many of us are familiar with those whose relationships end, but who do not legally end the relationship by applying for and obtaining a legally binding divorce decree. In some cases, one of the partners relocates and is estranged to such a degree that they are unable to be found. In order to complete the estate proceedings, private detectives may be needed to determine if the relocating spouse predeceased, making them unqualified to inherit, or to ensure that notice as required by the Surrogate’s Court is effectuated. In other cases, the parties have a cordial breakup and interact often. However, in either case, the spouse is entitled to inherit from the deceased party’s estate, unless a judgment of divorce was obtained during the lifetime of both parties. The Surrogate’s Court will often request a copy of the judgment of divorce, so it is important for parties to maintain such significant documents in an accessible location.

Our clients have inquired as to the consequences of the termination of a martial relationship upon rights in a New York estate. The resolution to this issue depends upon whether the relationship was legally terminated through a divorce and whether the estate is being conducted as an administration or a probate proceeding. Many of us are familiar with those whose relationships end, but who do not legally end the relationship by applying for and obtaining a legally binding divorce decree. In some cases, one of the partners relocates and is estranged to such a degree that they are unable to be found. In order to complete the estate proceedings, private detectives may be needed to determine if the relocating spouse predeceased, making them unqualified to inherit, or to ensure that notice as required by the Surrogate’s Court is effectuated. In other cases, the parties have a cordial breakup and interact often. However, in either case, the spouse is entitled to inherit from the deceased party’s estate, unless a judgment of divorce was obtained during the lifetime of both parties. The Surrogate’s Court will often request a copy of the judgment of divorce, so it is important for parties to maintain such significant documents in an accessible location.

In the instances when a divorce was not obtained, this blog post will analyze the distinctions between an administration and a probate proceeding. This blog has discussed in general terms an estate administration proceeding, which is appropriate when a person dies without a will (intestate). New York’s Estates Powers and Trusts Law provides that the spouse receives the entire estate if there are no children. If there are children, the spouse will still receive $50,000.00 plus one-half of the rest of the estate. Certainly, a separated person would not wish for his spouse to receive the bulk of his estate, but this would be the result in an administration proceeding.

Should such a separated person not wish to divorce, he should have a will that is consistent with his wishes prepared by legal counsel in order to attempt to prevent this result. One should be mindful that in New York State, a spouse cannot be disinherited under most circumstances. A spouse has the right to her “elective share”, which is that amount that would have been inherited in the event of intestacy. An exception to this concept is obtaining a proper waiver of elective share document, wherein the party waives her right to her elective share in the spouse’s will. This document may be appropriate even when a relationship has not dissolved. For instance, one spouse may be independently wealthy and be willing to waive her elective share so that the children of the deceased receive the bulk of the estate. The waiving spouse may also be duly provided for by other assets such as life insurance.

Every Hoarder Needs a Clutter Reduction Program

Our readers may have read a recent article in The New York Times concerning a compulsive hoarder (or “collector”) and his struggle to clean out his rent-stabilized apartment in order to avoid eviction. While this situation is so notorious that it even became the subject of an episode of the television series “Hoarders”, unfortunately the issue is not uncommon. This blog post will discuss hoarding in the context of a cooperative or condominium building and the legal remedies that the cooperative or condominium board has to preserve the standard of living of the building’s residents.

Our readers may have read a recent article in The New York Times concerning a compulsive hoarder (or “collector”) and his struggle to clean out his rent-stabilized apartment in order to avoid eviction. While this situation is so notorious that it even became the subject of an episode of the television series “Hoarders”, unfortunately the issue is not uncommon. This blog post will discuss hoarding in the context of a cooperative or condominium building and the legal remedies that the cooperative or condominium board has to preserve the standard of living of the building’s residents.

Hoarding is more than a personal problem for a shareholder or unit owner. The board’s response needs to take into account more than merely trying to give the unit owner a clutter-free existence. The real concerns behind a neighbor’s hoarding are as follows. Hoarding can be a symptom of mental illness. In some cases this author, on behalf of a cooperative board, has needed to inform the shareholder’s next of kin of a potential mental illness that needs to be addressed or has commenced guardianship proceedings to have an individual appointed as guardian of the shareholder to promote the person’s safety and well-being.

Article 81 of New York State’s Mental Hygiene Law governs the procedure for appointing a legal guardian for an adult, as may be necessary to provide for personal needs (such as health and safety) and/or to manage financial affairs. Usually the Supreme Court in the county in which the alleged incompetent resides is the forum for the hearing and trial, but in some cases the Surrogate’s Court in the same county can adjudicate the matter if it is in the context of an already existing estate proceeding. The Court may appoint a guardian if there is clear and convincing evidence that the person will suffer harm because he is unable to provide for his personal needs and/or property management and the person cannot understand the consequences of such inability. The guardianship procedure can be brought by “a person otherwise concerned with the welfare of the person alleged to be incapacitated”. Such a proceeding is commenced by Petition and Order to Show Cause, personally served upon the alleged incompetent. An independent court evaluator is appointed to determine the person’s ability to manage the activities of daily living, ability to manage one’s own financial affairs, and the necessity of appointing a guardian. After a trial or hearing, the Court may appoint a guardian to handle the affairs of the incompetent, who must undergo training, post a bond and file reports with the Court at regular intervals.