The political season is well under way. Given that our country’s next presidential election is about 14 months away, we see more and more politicians gearing up for a run for our nation’s highest office. Another well-worn aspect of such political events is the use of a popular song by the politician during a rally.

The political season is well under way. Given that our country’s next presidential election is about 14 months away, we see more and more politicians gearing up for a run for our nation’s highest office. Another well-worn aspect of such political events is the use of a popular song by the politician during a rally.

Going hand-in-hand with such use of a song is the usual objection by the songwriter when the politician using the song has political views objectionable to the writer. Some recent examples are Donald Trump’s use of R.E.M.’s song “It’s the End of the World as We Know It (And I Feel Fine),” and Rowan County, Kentucky Clerk Kim Davis‘ use of the song “Eye of the Tiger” by Survivor when rallying against the issuance of marriage certificates to same sex couples.

In each case, the musician has objected to the use of their song during these political rallies. This blog post will explain the legal underpinnings of such objections. Who has the legal right to prevent a song from being used, and under what circumstances? The answer lies in the U.S. copyright law.

As we enter the last days of summer,

As we enter the last days of summer, It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask

It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask

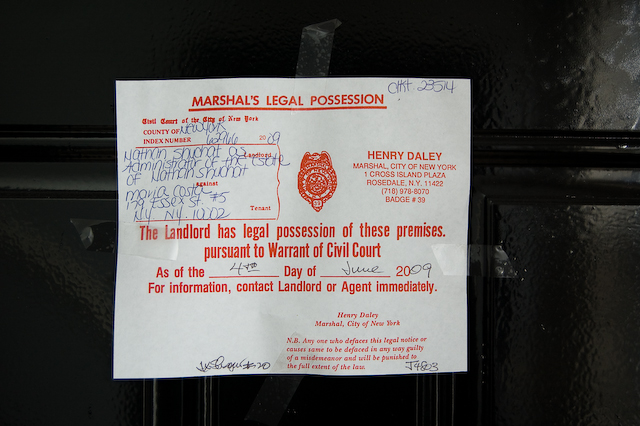

Many of our clients are landlords who own only one property, such as a single or multi-family house or an apartment. Although they may be renting to a tenant, it is not their primary business or livelihood. As such,

Many of our clients are landlords who own only one property, such as a single or multi-family house or an apartment. Although they may be renting to a tenant, it is not their primary business or livelihood. As such,

A recent

A recent  One of

One of