It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask us how such shares can be transferred after a person passes away. This post will answer the question.

It is not unusual for the estate of a deceased person to hold stock as an asset. Stock can take the form of shares held in a publically traded company, such as Target, or shares in a cooperative corporation. Clients often ask us how such shares can be transferred after a person passes away. This post will answer the question.

First, it needs to be determined whether the person had a Will. If there was a Will, there may have been a specific bequest of the stock. This takes the form as follows: “I give all shares that I may hold at the time of my death in Target to my daughter.” If the stock is not addressed specifically, then the residuary clause of the Will manages its disposition. Anything not specifically addressed is left to the party receiving the residuary.

If the person did not have a Will, then the rules of intestacy would dictate who would receive the stock. In New York, Section 4-1.1 of the Estates Trust and Powers Law governs the situation. For instance, if the closest surviving person to the deceased is a child, then the child would inherit the stock under New York law.

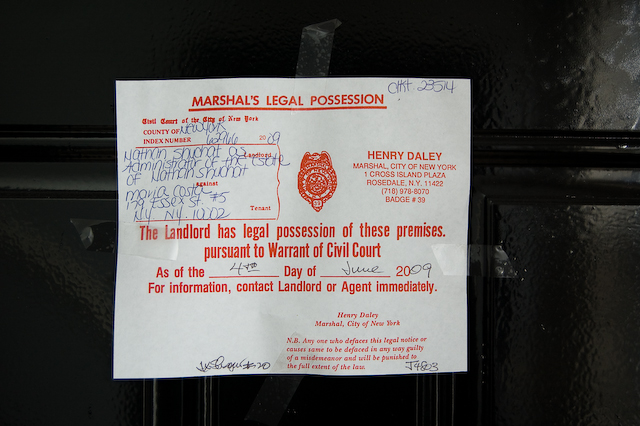

Many of our clients are landlords who own only one property, such as a single or multi-family house or an apartment. Although they may be renting to a tenant, it is not their primary business or livelihood. As such,

Many of our clients are landlords who own only one property, such as a single or multi-family house or an apartment. Although they may be renting to a tenant, it is not their primary business or livelihood. As such,

A recent

A recent  One of

One of A

A  After another harsh winter in New York, many of us are looking forward to getting away this Memorial Day weekend. Those of us who are driving may have acquired the vehicle from an estate. This post will address

After another harsh winter in New York, many of us are looking forward to getting away this Memorial Day weekend. Those of us who are driving may have acquired the vehicle from an estate. This post will address  Parties to real estate transactions often ask

Parties to real estate transactions often ask