Vacating a Default in Eviction Cases

Our firm frequently handles eviction actions on behalf of both landlords and tenants. In order to commence an eviction action, the tenant is served with a Notice of Petition and Petition. These documents state the date, time and location of the Court in which to appear. One common occurrence is when a tenant fails to appear in Court for a scheduled hearing. This post will address how such a situation is resolved.

Our firm frequently handles eviction actions on behalf of both landlords and tenants. In order to commence an eviction action, the tenant is served with a Notice of Petition and Petition. These documents state the date, time and location of the Court in which to appear. One common occurrence is when a tenant fails to appear in Court for a scheduled hearing. This post will address how such a situation is resolved.

Sometimes the tenant fails to appear at the hearing. Whether it is because they did not actually receive the notice, cannot get to Court for health reasons, a failure to understand the nature of the proceedings, or otherwise, the Court will enter a default against the tenant. What this means is that by failing to appear and present a defense, the landlord is entitled to receive the relief requested in their Petition. Depending on the type of eviction proceeding, this relief will usually consist of a money judgment (in a non-payment proceeding) for the amount of rent claimed to be owed by the tenant, as well as a warrant of eviction. The warrant is a legal document that allows the property owner to enlist a City Marshal or Sheriff (depending on where the property is located) to physically evict the tenant and remove his belongings from the premises.

Depending on the particular local court in which the action is brought, the Judge may sign these documents immediately or they may be submitted to the Court Clerk for the Judge’s signature at a future date. Once the warrant is signed, the landlord will send it to the City Marshal or Sheriff to proceed with the eviction. The tenant will then be served with a 72 hour notice, which states that the eviction will proceed in three days.

Anchors Aweigh- Large Tenant Demands

News outlets have recently reported that numerous Sears locations will be imminently closing. Our readers are most likely aware that Toys R Us has closed all of its locations due to its bankruptcy filing. Both Sears and Toys R Us would be considered anchor tenants by commercial landlords. An anchor tenant leases a large square footage space or is of the nature of a large and influential company such as Starbucks or Apple. Anchor tenants such as department stores and movie theaters draw customers to the mall or shopping center, so that the same customer continues to shop at the premises and patronize its other businesses. Once an anchor tenant closes, the landlord should seek to locate another anchor tenant to fill the vacant space, so that the shopping mall will draw customers to the anchor location and benefit the other businesses in the mall by drawing shoppers. This post will examine the provisions that a potential anchor tenant will ask its attorney to have included in a lease.

News outlets have recently reported that numerous Sears locations will be imminently closing. Our readers are most likely aware that Toys R Us has closed all of its locations due to its bankruptcy filing. Both Sears and Toys R Us would be considered anchor tenants by commercial landlords. An anchor tenant leases a large square footage space or is of the nature of a large and influential company such as Starbucks or Apple. Anchor tenants such as department stores and movie theaters draw customers to the mall or shopping center, so that the same customer continues to shop at the premises and patronize its other businesses. Once an anchor tenant closes, the landlord should seek to locate another anchor tenant to fill the vacant space, so that the shopping mall will draw customers to the anchor location and benefit the other businesses in the mall by drawing shoppers. This post will examine the provisions that a potential anchor tenant will ask its attorney to have included in a lease.

Exclusive use can often be demanded by an anchor tenant. Should Bed Bath and Beyond be the proposed tenant, it may require in its lease that the landlord may not lease another space in the shopping center to a tenant that sells home décor, bedding, kitchen equipment and the like, so as to minimize competition that may hinder its business. Should the landlord violate such an exclusive use provision, the tenant’s lawyer may have negotiated a rent abatement and right to terminate the lease. In addition, many anchor tenants present their own form of lease to the landlord, rather than sign the landlord’s version of the lease.

Signage is very important to anchor tenants. Anchor tenant leases may include a provision that the anchor tenant must always be the first name on mall signage and be of the largest font size. Visibility of signage is also important, so that the anchor store’s name is listed on internal building directories, directional signs throughout the mall and the like.

Commercial Rent Control Proposed in New York

Recently, New York City Council Speaker Corey Johnson proposed a new law called the “Small Business Jobs Survival Act.” The Mayor of New York City, Bill de Blasio, has questioned the legal underpinnings of the proposed law. The law has also been described as legalizing commercial rent control in New York City. What are the legal issues involved in commercial rent control, and how will it affect small business owners with commercial leases in New York? This blog post will address these questions.

Recently, New York City Council Speaker Corey Johnson proposed a new law called the “Small Business Jobs Survival Act.” The Mayor of New York City, Bill de Blasio, has questioned the legal underpinnings of the proposed law. The law has also been described as legalizing commercial rent control in New York City. What are the legal issues involved in commercial rent control, and how will it affect small business owners with commercial leases in New York? This blog post will address these questions.

Currently, unlike certain residential properties, commercial properties are not subject to rent regulation such as rent control and rent stabilization. Many residential apartments in New York City, as well as Westchester County, are subject to rent regulation under the rent control and rent stabilization statutes. What this means is that tenants living in apartments subject to these regulations, under certain conditions, are entitled to perpetual renewal leases which cannot increase rent more than a certain percentage as set by the New York City Rent Guidelines Board.

However, these regulations do not currently apply to commercial properties. If a store is being rented to a tenant, only the free market regulates the amount of rent to be paid, and whether the lease will be renewed. Let’s give an example. A grocery store signs a commercial lease for 5 years with the rent set at $4,000.00 per month. At the end of the lease term, if the parties have not signed a new lease, the tenant would be considered a holdover and subject to eviction. Absent any specific provisions in the current lease relating to a lease renewal, the landlord is under no legal obligation to offer a new lease to the tenant. The landlord is also free, at the end of the lease term, to request a rent increase to $7,000.00 per month. If the tenant does not agree to the new rental rate, again, they would have to vacate the premises or be subject to eviction.

Controlling Tenant Attributes in Commercial Leases

Landlords who lease commercial space typically concern themselves with the quality of a proposed tenant so that such character is consistent with that of other tenants occupying the property. Such concern is reflected in particular provisions found in a commercial lease. This post will discuss some of the more common tenant “character” provisions.

Signage is important to commercial tenants so that the store’s location is visible and identifiable to potential customers. Because landlords are concerned that certain signage may look physically unpleasing or be harmful to the reputation of the property, landlords typically specify signage requirements in the lease. The landlord will reserve the right to approve the signage sought to be used by the tenant and will usually not allow a sign that appears to be too large or has too much neon compared to other signs already used at the property. Of course, signs containing vulgar words will not be permitted. When negotiating your lease, your attorney should also negotiate an exhibit to the lease which will contain a drawing of exactly how your sign will look with specific dimensions referenced. That way, the parties will have already decided on the approved signage before the lease is signed.

Landlords also want to control store hours. Many leases have provisions to that effect. In a shopping mall environment, most leases will require stores to be open for the same number of hours. Such a provision benefits all tenants, as the mall is more likely to be a thriving place in which to do business if shoppers can visit more than one store. On the flip side, landlords may demand that a public storefront be closed after a certain hour so that visitors do not “hang out”, impairing the reputation of the property or creating too much noise, impacting neighbors of the property.

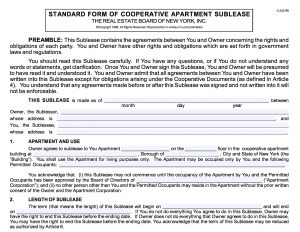

Subletting and Possible Cooperative Rule Violations

Previous blog posts have discussed potential cooperative rule violations and the procedures to be followed by the co-op when a shareholder violates provisions of the proprietary lease or the house rules. This post will discuss more specifically the issues which arise when a shareholder attempts to sublet their co-op apartment to another person.

Previous blog posts have discussed potential cooperative rule violations and the procedures to be followed by the co-op when a shareholder violates provisions of the proprietary lease or the house rules. This post will discuss more specifically the issues which arise when a shareholder attempts to sublet their co-op apartment to another person.

It first should be noted that most co-ops have in their proprietary leases specific rules about who can live in the apartment, if they are not the shareholder listed as an owner on the share certificate. It is usually limited to direct relatives, such as one’s spouse, children, parents, domestic partner, and the like. Having these people live in the apartment at the same time as the shareholder is not considered a sublet situation. However, the proprietary lease usually also has rules limiting usage. The shareholder must also be living at the apartment, together with the relatives in or guests question.

To give an example, let’s say the shareholder is elderly and shares the apartment with her adult son. She then decides to move to Florida and wishes for her son to continue living in the apartment in New York. This would most likely be considered a violation of the proprietary lease by the co-op, as the shareholder is no longer living at the unit. Such a violation, if discovered by the co-op, could result in a default notice being issued to the shareholder for having unauthorized persons residing at the apartment. Note again that if the shareholder is living at the unit at the same time with her family, it would probably not be considered a violation. The reasoning behind this is that the co-op wants their units to be owner-occupied and to approve those occupying the apartment. They will allow direct family members to share the unit, but only when the owner is also living there.

Defending Cooperative Foreclosures in New York

Several of our prior blog posts have dealt with defending foreclosure actions for real property. However, in New York State, and especially in New York City, many apartments are held as shares in a cooperative corporation, also known as “coops”. Rather than owning real property, coop owners own shares in a corporation which have been allocated to their apartment within a particular building. As a result, legally, owners of a coop apartment do not own real property, but instead, they own shares.

Several of our prior blog posts have dealt with defending foreclosure actions for real property. However, in New York State, and especially in New York City, many apartments are held as shares in a cooperative corporation, also known as “coops”. Rather than owning real property, coop owners own shares in a corporation which have been allocated to their apartment within a particular building. As a result, legally, owners of a coop apartment do not own real property, but instead, they own shares.

This legal distinction makes a difference when an owner defaults on his share loan. Because coops are not real property, they fall into a category called “non-judicial foreclosures.” This means that unlike a foreclosure against real property, foreclosure actions against coop shares are not brought by commencing a lawsuit in the Supreme Court, or in any Court. Instead, the foreclosing lender will issue a series of legal default notices, and, if the default is not cured, it will then hold a public auction of the coop shares belonging to the defaulting shareholder.

Because lenders hold the shares in escrow when they make a loan against the apartment, they have the ability to auction these shares when the shareholder defaults in his loan obligation. The original share certificate is kept by the lender and not returned to the shareholder until the loan is paid in full.

Respecting the Queen of Soul: Money Sweeter than Honey

Music lovers, reeling from the recent news of Aretha Franklin’s death, have now found out that the “Queen of Soul” died intestate, without a will. This blog has previously addressed the matter of another musician, Prince, having passed away without a will and the legal repercussions. We will address the legal issues that have arisen once the “Queen of Soul” passed away without a will.

Music lovers, reeling from the recent news of Aretha Franklin’s death, have now found out that the “Queen of Soul” died intestate, without a will. This blog has previously addressed the matter of another musician, Prince, having passed away without a will and the legal repercussions. We will address the legal issues that have arisen once the “Queen of Soul” passed away without a will.

In Michigan, where Ms. Franklin had her primary residence, the assets of an unmarried person are left in equal shares to her children. New York would have a similar disposition. Devil’s advocates might say that if the legal result of having no will is the same as having a will, that the children will inherit the assets, what is the benefit of having a will? First, if one has a will, the fiduciary of the estate (Executor) can be selected by the decedent, rather than the default person being selected according to statute. For instance, musicians such as Prince and Aretha Franklin leave vast music catalogs deserving of post-death management by an expert who has knowledge of how to handle such specialized assets. Second, a person making a will may have a preference for how the assets will be distributed, instead of the statutory default of all children sharing equally. If Ms. Franklin had devoted greater consideration to this issue, she may have found it appropriate for the “red roses” in the garden in “Spanish Harlem” to be transferred to the child who would most appreciate and care for this asset. Further, family infighting over her “pink Cadillac” could have been avoided, so that the ride “on the freeway of love” could take place without delay.

Apparently, Ms. Franklin valued privacy and nondisclosure of her assets during her lifetime. The best way for her to have avoided the additional public disclosure that takes places when one dies without a will would be to have made a revocable trust. That way, assets titled in the name of the trust would be transferred automatically after death as directed in the trust, with no public disclosure and without Court intervention and the delays that it may entail.

Converting Stores to Apartments – A Solution to Westchester’s Housing Shortage?

Recent news in Westchester County is that the Wal-Mart store in downtown White Plains is scheduled to close on August 10 of this year. Our blog has recently explored the legal issues relating to a store closing for good, especially where there is an existing lease.

Recent news in Westchester County is that the Wal-Mart store in downtown White Plains is scheduled to close on August 10 of this year. Our blog has recently explored the legal issues relating to a store closing for good, especially where there is an existing lease.

An interesting point regarding the Wal-Mart closing is that it is been suggested that the store be replaced with a residential building or be converted as exists into apartments. Many area residents who decide to move out of New York City are seeking homes in Westchester County. However, Westchester has a limited housing stock, and many of the current homes in Westchester date from the immediate post-war period, or are even older, and the lack the amenities many new home buyers are seeking.

In addition, the economics of supply and demand mean that due to the low current supply of housing stock in Westchester, housing prices are quite high and will likely continue to rise over time. Since demand is unlikely to decease, the only way to lower prices would be to increase the supply of housing. Other areas in the United States are experiencing similar housing shortages. Further, recent changes to the federal income tax laws concerning limits on the deduction of real estate taxes have affected the real estate market.