A recent gas explosion in Manhattan’s East Village destroyed an entire building, and, more unfortunately, caused the deaths of at least two individuals and injuries to other people who were unlucky to be in the building during the explosion. Of course, the human cost of such a tragedy cannot be measured. This blog post will attempt to explain some of the legal issues that relate to illegal actions on the part of a landlord or a tenant.

A recent gas explosion in Manhattan’s East Village destroyed an entire building, and, more unfortunately, caused the deaths of at least two individuals and injuries to other people who were unlucky to be in the building during the explosion. Of course, the human cost of such a tragedy cannot be measured. This blog post will attempt to explain some of the legal issues that relate to illegal actions on the part of a landlord or a tenant.

Apparently the gas explosion may have been caused by the illegal siphoning of a gas line by the building’s landlord. If this is indeed the case, the landlord would be legally responsible for any injuries caused by the explosion, including the deaths of the individuals. Such legal responsibility be in both the civil and criminal categories. This means that the persons responsible for the illegal siphoning may face charges of criminal negligence, and be subject to arrest and jail time.

In addition, any persons damaged by the explosion may file civil suits seeking money damages for their injuries. This may also include wrongful death actions brought by the legal heirs of those killed in the explosion. A wrongful death suit usually seeks damages in the amount of future earnings by those who may have been legally dependent on the person who died. It is usually brought by a surviving spouse or child of the decedent. Those found to be legally responsible for the death of the individuals in the explosion may have to pay compensation in the amount of estimated lifetime future earnings of the person who died as a result of their negligence.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog

One of the most frequently asked questions when our firm meets with a new client relates to the awarding of attorney’s fees. Many of our landlord-tenant clients ask us whether they can recover their attorney’s fees in Court from the other party in the litigation. The answer to this question is not a simple one, and this blog post will answer under what circumstances a party may recover their attorney’s fees from the other party, whether in a landlord-tenant litigation, or other type of case.

One of the most frequently asked questions when our firm meets with a new client relates to the awarding of attorney’s fees. Many of our landlord-tenant clients ask us whether they can recover their attorney’s fees in Court from the other party in the litigation. The answer to this question is not a simple one, and this blog post will answer under what circumstances a party may recover their attorney’s fees from the other party, whether in a landlord-tenant litigation, or other type of case.  First, we would like to wish all followers of our blog a happy and healthy 2015. We look forward to continued successful legal outcomes for all of our clients in the New Year.

First, we would like to wish all followers of our blog a happy and healthy 2015. We look forward to continued successful legal outcomes for all of our clients in the New Year.  A recent

A recent  Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend,

Memorial Day weekend is eagerly anticipated by many of our readers, especially this year after the harsh winter that we endured. Fortunate travelers expect to enjoy their vacation homes this weekend. As you head out for the weekend,

A

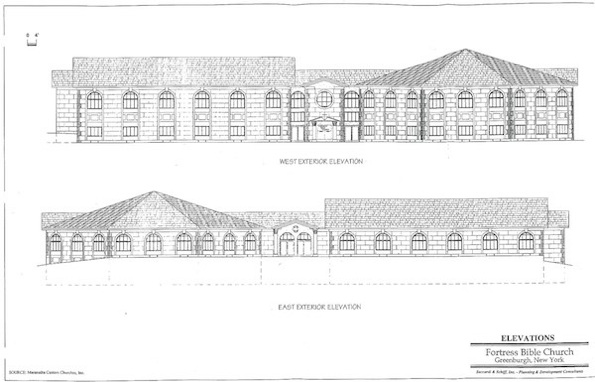

A  In 1999, the Town Board of Greenburgh, located in Westchester County, New York, reviewed an application of the Fortress Bible Church to build a church and school on land that it owned within the Town borders. After review by the Town Board, the Board rejected the application, claiming that there were safety concerns regarding inadequate stopping distance from the main road to the Church entrance, as well as general safety issues related to traffic entering and exiting the Church site.

In 1999, the Town Board of Greenburgh, located in Westchester County, New York, reviewed an application of the Fortress Bible Church to build a church and school on land that it owned within the Town borders. After review by the Town Board, the Board rejected the application, claiming that there were safety concerns regarding inadequate stopping distance from the main road to the Church entrance, as well as general safety issues related to traffic entering and exiting the Church site.