Our firm handles real estate transactions as well as landlord-tenant matters. At certain times, these two areas of the law may intersect. One situation which occurs frequently is when a multi-family house is sold by its owner, who may have one or more tenants living at the property.

Our firm handles real estate transactions as well as landlord-tenant matters. At certain times, these two areas of the law may intersect. One situation which occurs frequently is when a multi-family house is sold by its owner, who may have one or more tenants living at the property.

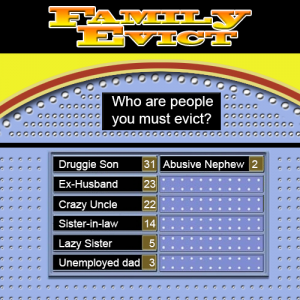

In such a situation, what are the legal responsibilities regarding the tenants? Most standard real estate sale contracts contain a clause requiring that the property be conveyed vacant and free of tenants. Unless there is a rider to the contract modifying this clause, this means that it is the seller’s responsibility to remove all tenants prior to closing. When our attorneys are confronted with such a situation, the first thing to do is to ask the proposed new owner’s attorney whether they wish to retain the tenants living at the premises. It is possible that the new owner would also like to rent the property, or a portion of same, and does not want to go through the time and expense of locating new tenants after the purchase is complete.

If the new owner wishes to retain the tenants after she purchases the property, the next step is to determine whether the current tenants have a written lease for the premises. If they do, the lease should be reviewed by the buyer’s attorney, and, at closing the lease should be legally assigned to the new owner. What this means is that the new owner “steps into the shoes” of the former owner regarding the obligations under the lease. Any security deposit being held by the seller of the property should be transferred to the buyer at the closing. In addition, any rent already paid by the tenant prior to the closing should be pro-rated at the closing. For example, a closing is scheduled for April 15. The tenant pays his monthly rent of $1,000.00 on April 1 as per his lease. At the closing, the buyer should receive a $500.00 credit as his share of the rent for the one-half month that he owns the property. He will collect rent directly from the tenant starting in the first month after the closing.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog