Prior blog posts have discussed the legal steps required to foreclose property in New York State. Often, our firm will encounter a foreclosure case that has been in litigation for many years. In fact, it is entirely possible for a foreclosure matter in New York to take between five and ten years from the commencement of an action to the final sale of the property at auction. Even after the final sale, there may be additional landlord-tenant litigation involving the owner or tenant being evicted from the foreclosed property.

Prior blog posts have discussed the legal steps required to foreclose property in New York State. Often, our firm will encounter a foreclosure case that has been in litigation for many years. In fact, it is entirely possible for a foreclosure matter in New York to take between five and ten years from the commencement of an action to the final sale of the property at auction. Even after the final sale, there may be additional landlord-tenant litigation involving the owner or tenant being evicted from the foreclosed property.

This post will discuss the legal ramifications of a delay in a foreclosure procedure. Foreclosure cases can be delayed for many reasons. Common reasons are court backlog, which may involve a Judge taking up to a year to render a decision on a motion, or simply failure of the lender or their attorneys to expeditiously file the various necessary motions in order to advance the case. Experienced counsel for the defendant may also further delay the case’s progress by interposing legitimate defenses to the action, such as a lender’s failure to provide the correct notices to the borrower as required by law.

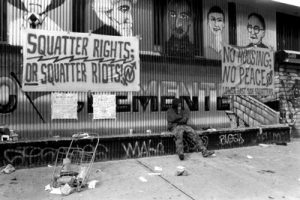

As a result, the case may take years to resolve itself. What is the effect of such a delay? The first effect is that if the borrower is residing at the property, it allows her time to arrange for new living arrangements. If there is insufficient equity in the property, and the borrower feels that ultimately, it will be sold at an auction, any delay will allow her to continue living at the premises while the case plays out in Court. Even after the property is sold, the new owner must bring separate legal proceedings in order to evict any persons living at the premises. Our attorneys may be able to negotiate with the new owner to give the former owner sufficient time to obtain a new residence and arrange for movers. We have even successfully negotiated for the new owner to pay the prior owner’s moving expenses in order to have the property vacated.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog