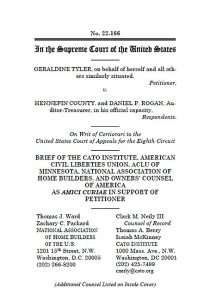

Longtime readers of this blog will remember several prior posts relating to the recovery of surplus funds in tax lien foreclosures. The United States Supreme Court ruled in Tyler v. Hennepin County, Minnesota whether the government could keep surplus funds in tax lien foreclosures. The ultimate ruling was that it was an unconstitutional taking of property for a municipality to retain excess funds in a tax lien foreclosure.

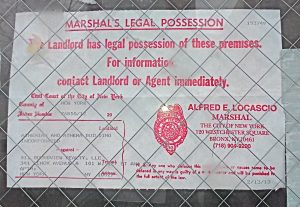

To summarize, if a property is sold at a tax auction in order to satisfy a lien for unpaid property taxes, and the amount for which the property is sold exceeds the amount of past due taxes, the (former) property owner is now legally entitled to the surplus funds raised by the auction. Prior to the Supreme Court’s decision, certain states (including New York) would simply keep any excess funds collected in the auction, and the former owner would have no claims to these funds under the applicable state laws, which have now been held to be unconstitutional.

What does this mean on a practical basis? Although it is beyond the scope of this blog to discuss how other states are handling the situation, counties in New York State have been preparing databases showing the surplus funds, if any, raised in tax lien sales. These lists show the amount of the tax lien, the date of the tax auction, the sum for which the property was sold at the auction, and the surplus funds being held by the county. Under the Supreme Court decision in Tyler, the former owner now has a right to claim these funds in New York.

New York Real Estate Lawyers Blog

New York Real Estate Lawyers Blog